UNDERSTANDING PERFORMANCE FEES

The performance fee is an incentive-based fee paid only when the Fund’s performance exceeds a specific threshold. Our approach to performance fees ensures fees are tied to outcomes: you pay more only when we deliver more. It’s a model built on accountability and performance alignment.

WHEN PERFORMANCE FEES ARE APPLIED

Depending on the Fund, performance fees are earned when either two performance conditions are met by each class of units:

Absolute Performance

For PICTON Funds with an absolute performance fee, the performance fees are earned when two criteria are met, the class achieves performance returns that exceed the annual hurdle rate and the returns are above the high-water mark for that class.

A. The Hurdle Rate: The minimum return that the class must meet before a performance fee can be charged. The hurdle rate is reviewed and reset each year on January 1st.

B. The High-Water Mark: The high-water mark refers to the highest value the net asset value per unit (NAV) of the class has ever reached. To earn a performance fee, the performance of the class has to be above the high-water mark. If the value of the NAV is below the high-water mark, no performance fees are charged. This ensures that investors do not pay for the same performance twice.

Performance Relative to Benchmark

For PICTON Funds with a relative performance fee, the performance fee is earned only when the performance return exceeds the benchmark on a cumulative basis since this last quarterly period a performance fee was paid. When performance return is below the benchmark, no fees are charged.

HOW PERFORMANCE FEES ARE CALCULATED

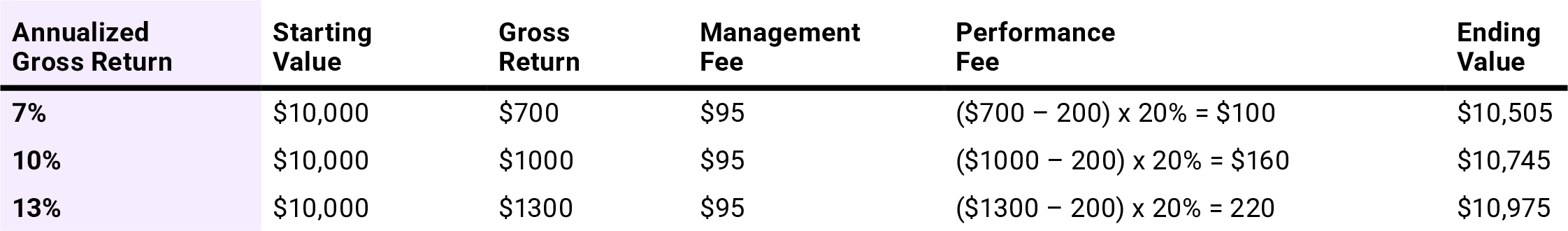

Example 1 – Performance Fees and Gross Return

Using a fund with a 0.95% management fee, a 2% hurdle rate and a 20% performance fee that has consistently been above the high-water mark as an example, a simplified calculation that can help illustrate performance fees is: Starting Value + Gross Return – Management Fee – (Performance Fee – Hurdle Rate)

For illustrative purposes only. Not meant to replicate an actual calculation for a PICTON Fund.

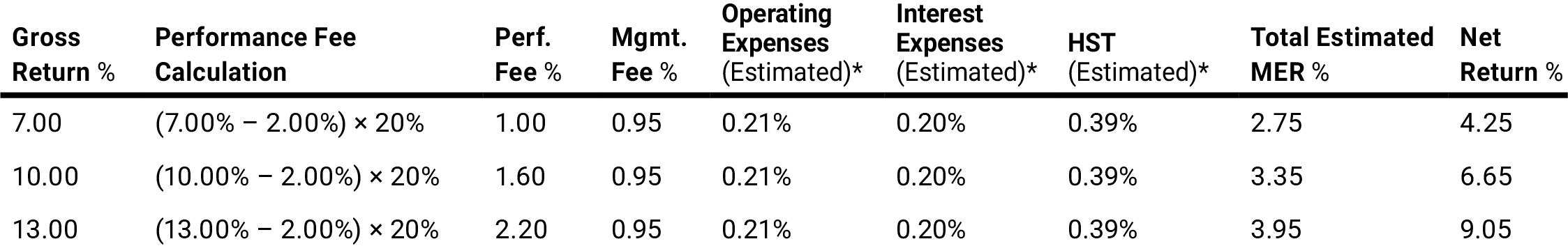

Example 2 - Performance Fees and Net Return

Using the same fund with a 0.95% management fee, a 2% hurdle rate and a 20% performance fee

that has consistently been above the high-water mark, here is a simplified example of how applied

performance fees are reflected in its management expense ratio (MER).

For illustrative purposes only. Not meant to replicate an actual calculation for a PICTON Fund.

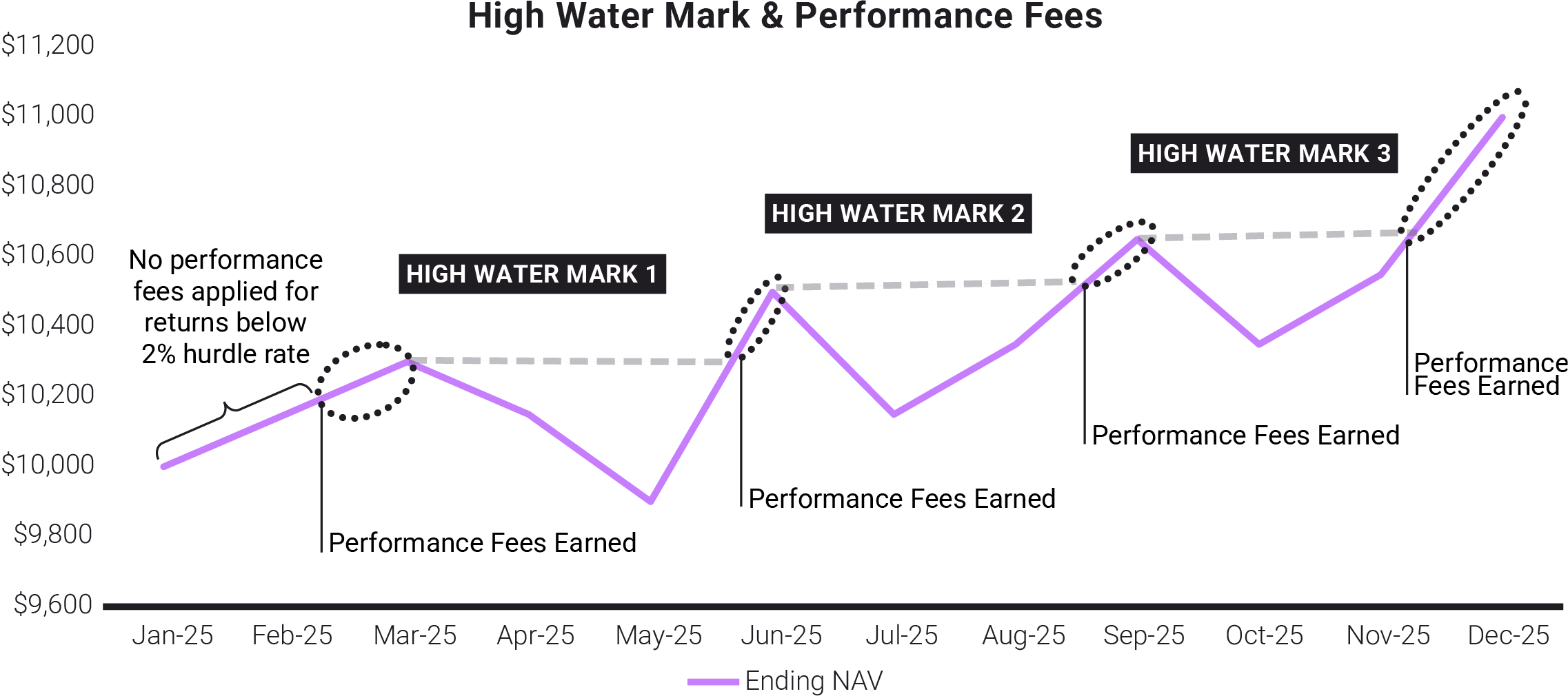

UNDERSTANDING THE HIGH-WATER MARK

For Funds with an absolute performance fee, it is important to note that the performance fee is

earned only when the applicable class of units of the Fund is above its high-water mark. The highwater

mark is perpetual and is based on the highest NAV the that class has achieved. When the

performance of the class is below the high-water mark, no performance fees are charged.

For illustrative purposes only. Not meant to replicate an actual calculation for a PICTON Fund.

HOW PERFORMANCE FEES ARE ACCRUED

When performance fees are earned, the fees are calculated, accrued and reflected each time the NAV

for that class of units is calculated. This means that the NAV is inclusive of any performance fees.

For the Funds where performance fees are calculated daily: If the performance fee is earned,

that performance fee is calculated, accrued and reflected in each day’s NAV for each class of

units of the Fund.

For the Funds where performance fees are calculated weekly or monthly: If the performance

fee is earned, that performance fee is calculated, accrued and reflected in the weekly or

monthly NAVs for each class of units of the Fund, as applicable.

REPORTING ON PERFORMANCE FEES

Performance Fees are included in the Management Expense Ratios (MERs), which are disclosed in

the Fund’s regulatory documents such as the Fund Facts, ETF Facts and annual and semi-annual

Management Report of Fund Performance (MRFP). Reach out to your wholesaler contact for a

breakdown of what is included in the MER for each fund.

A NOTE ON MER REPORTING

The Fund’s regulatory documents, and the MER information contained within are disclosed as at

a point in time, often, as at June 30 and December 31. Third-party platforms often disclose MERs

based on the most recent MER data available. The posted MER includes the performance fees earned

as at the time of the disclosure, which could be from the previous year, and may not accurately reflect

current MER that is based on the performance returns of the fund in the current year.

HOW PERFORMANCE IS STATED

Performance returns which are stated as net of fee returns already reflect any performance fees earned.

This material has been published by Picton Mahoney Asset Management (“PICTON Investments”) on September 5, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns.

Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Alternative mutual funds can only be purchased through a registered dealer and are available only in those jurisdictions where they may be lawfully offered for sale.

© 2025 Picton Mahoney Asset Management. All rights reserved.